Table of Contents

Milestone Credit Card $700: Milestone Credit Card Review: However, getting a credit card with a low credit limit can be challenging, especially for people with limited credit or a low credit score. This is where the Milestone Credit Card comes into play. With its $700 credit limit, the Milestone Credit Card gives individuals the opportunity to establish or rebuild their creditworthiness. In this comprehensive review, we will delve into the features, benefits, and frequently asked questions about the Milestone Credit Card.

Milestone Credit Card $700: Milestone Credit Card Review

The Milestone Credit Card, specifically the Milestone Mastercard® – $700 Credit Limit, is designed for individuals who are looking to improve their creditworthiness. This card is particularly suitable for those with limited credit or a low credit score. By providing a modest credit limit of $700, the Milestone Credit Card offers cardholders the opportunity to demonstrate responsible credit usage and build a positive credit history over time.

Read Also: Milestone Credit Card Pre Approval

Milestone Credit Card Details

| Max Late fee | $40 |

| MAX OVER LIMIT FEE | $40 |

| MAX PENALTY APR | 29.9% |

| FOREIGN TRANSACTION FEE | 1% |

| SMART CHIP | NO |

| CASH ADVANCE APR | 29.9% |

| CASH ADVANCE FEE | 1st year 0%, either $5 or 5% after |

Features and Benefits

- Credit Limit: The Milestone Credit Card comes with a $700 credit limit, providing users with an initial line of credit to make purchases and payments.

- Credit Reporting: One of the key benefits of the Milestone Credit Card is its reporting to major credit bureaus. Responsible card usage and timely payments can help individuals improve their credit score over time.

- Easy Application Process: The application process for the Milestone Credit Card is straightforward and can be completed online. Individuals with limited credit or a low credit score may have a higher chance of approval compared to traditional credit cards.

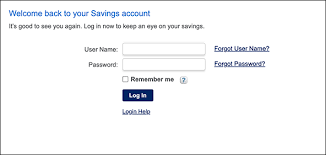

- Online Account Management: Cardholders can easily manage their Milestone Credit Card account online. This feature allows users to track their transactions, make payments, and monitor their credit progress conveniently.

- No Security Deposit: Unlike some secured credit cards, the Milestone Credit Card does not require a security deposit. This aspect makes it more accessible to individuals who may not have the funds for a deposit.

- Additional Cardholder Benefits: The Milestone Credit Card offers additional benefits, including fraud protection, zero liability for unauthorized transactions, and extended warranty coverage.

$750 Milestone Mastercard Approval – Prequalify With No Hard Inquiry -Minimum 500 Score

Frequently Asked Questions (FAQ) About Milestone Credit Card $700: Milestone Credit Card Review

Is the Milestone Credit Card suitable for individuals with limited credit?

Yes, the Milestone Credit Card is specifically designed for individuals with limited credit or a low credit score. It offers a modest credit limit of $700 to help individuals establish or rebuild their creditworthiness.

How can the Milestone Credit Card help improve my credit score?

The Milestone Credit Card reports to major credit bureaus, which means your responsible credit usage and timely payments will be reflected in your credit history. By using the card responsibly, making payments on time, and keeping credit utilization low, you can gradually improve your credit score over time.

Can I manage my Milestone Credit Card account online?

Yes, the Milestone Credit Card provides an online account management platform. Cardholders can easily track their transactions, make payments, and monitor their credit progress conveniently from their computer or mobile device.

Does the Milestone Credit Card require a security deposit?

No, the Milestone Credit Card does not require a security deposit. This aspect makes it more accessible for individuals who may not have the funds for a deposit but still want to establish or rebuild their credit.

What additional benefits does the Milestone Credit Card offer?

In addition to the credit-building opportunity, the Milestone Credit Card provides benefits such as fraud protection, zero liability for unauthorized transactions, and extended warranty coverage. These features add value and security to your credit card experience.

Final Words

The Milestone Credit Card is an excellent option for individuals looking to establish or rebuild their credit history. With its $700 credit limit and reporting to major credit bureaus, this card provides a valuable opportunity for responsible credit usage and credit score improvement. The easy application process, online account management, and additional cardholder benefits make the Milestone Credit Card a comprehensive package for those seeking to take control of their financial future. If you’re ready to take the first step toward a stronger credit profile, the Milestone Credit Card may be the perfect tool to help you achieve your goals.