Table of Contents

In this instructional exercise, we will learn Income Tax Returns (ITR): How to file, e-verify, ITR 1, ITR 2, ITR 3, ITR 4 explained, last date . The last date for filing Income Tax Return (ITR) for the financial year 2021-22 and assessment year 2022-23 is July 31. This means taxpayers have two weeks left to pay the amount and after the deadline, they may have to pay. 5000 as late fee. Also read- More than 4 crore income tax returns filed so far, if not filed yet, hurry up and avoid penalty

Taxpayers need to keep documents like Aadhar card, Voter ID card, PAN card and other documents ready while filing ITR online.

Income Tax Returns (ITR): How to file, e-verify, ITR 1, ITR 2, ITR 3, ITR 4 explained, last date

- If you get a salary, you may simply submit your Form 16 and ClearTax will immediately generate your return and assist you in rapidly completing the electronic filing process.

- The simplest location to e-file your ITR-4 is ClearTax if you are a freelancer, small business owner, or operate a home-based business like a Kirana store or an e-commerce vendor (Section 44AD or 44ADA). Your income tax return can be prepared by our CAs and e-filed. Please view our CA-supported plans here.

- Selecting the appropriate ITR form for you is done automatically by ClearTax. We accept ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, and ITR-7 forms.

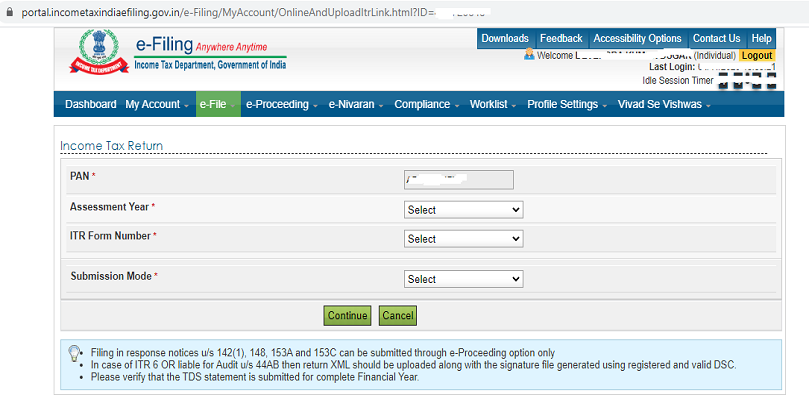

How to file ITR online

- Here is the e-filing website

- If you haven’t already, create a password and register on the site using your PAN number.

- Select “File income tax return” from the e-Filing menu after clicking there.

- After selecting the ITR filing year, click Continue.

- ITR filing can be done offline or online.

- To file an ITR copy, choose the online option.

- Select ITR file as individual.

- Choose ITR 1 or ITR 4, then click Proceed.

- Indicate the ITR filing reason and choose an item from the drop-down menu

- Enter the information for the bank account where you wish the IT refund sent.

- With the help of pre-filled information, such as bank interest rates, capital gains, and more, file the ITR copy.

- Send the ITR document for verification by courier to the website’s Centralized Processing Center in Bengaluru.

- Aadhaar OTP or EVC generated by a bank ATM are other methods of e-verification. When taxpayers are in poor mobile network range and need to complete income tax operations that often require OTPs, the option for static passwords also makes it easier to operate.

Important due dates of income tax return filing for FY 2021-22

| Due date | Nature of Compliance | Compliance Particulars | Forms/ documents |

| 15.06.2022 | Advance tax | First instalment for FY 2022-23 | Challan No./ITNS 280 |

| 31.07.2022 | ITR filing (for non-audit cases) | ITR filing for FY 2021-22 | Applicable ITR Form |

| 15.09.2022 | Advance tax | Second instalment for FY 2022-23 | Challan No./ITNS 280 |

| 30.09.2022 | Tax audit report (other than transfer pricing) | Tax audit report for FY 2021-22 | Form 3CA/3CB and 3CD |

| 31.10.2022 | Transfer Pricing Report (undertaken international or specified domestic transactions) | Submission of reports for FY 2021-22 | Form 3CEB |

| 31.10.2022 | ITR filing (for audit cases without transfer pricing) | ITR filing for FY 2021-22 | Applicable ITR Form |

| 30.11.2022 | ITR filing for transfer pricing cases | ITR filing for FY 2021-22 (if having international or specified domestic transactions) | Applicable ITR Form |

| 15.12.2022 | Advance tax | Third instalment for FY 2022-23 | Challan No./ITNS 280 |

| 31.12.2022 | Belated return or revised return filing | Belated return or revised return for FY 2021-22 | Belated/revised return |

| 15.03.2024 | Advance tax | 1. Fourth instalment for FY 2022-23 2. Single and final instalment for taxpayers opting for presumptive taxation scheme for FY 2022-23 | Challan No./ITNS 280 |

How to e-Verify Your Income Tax Return

- Generate Aadhaar OTP

- Existing Aadhaar OTP

- Existing EVC

- Generate EVC through a bank account

- Generate EVC through the Demat account

- Generate EVC through bank ATM option (offline)

How to fill out the verification document?

1. Input all necessary details.

2. Check if the data furnished is correct, such as:

- Name

- Address

- Contact details

- PAN

- Filing status

- Audit information

- Income details

- Debts

- Tax liability

- Taxes paid

3. Ensure the document is duly signed or attested.

4. State the designation/ capacity of the person signing/ verifying the return.

Who cannot file the ITR-5 form?

- Individual assesses

- Hindu Undivided Family (HUF)

- Company

- Taxpayers who must file tax returns in Form ITR-7, under Sections 139(4A), 139(4B), 139(4C), 139(4D), 139(4E) or 139(4F).

You can easily file your ITR 5 online in a hassle-free manner. Make sure that the return is filed before the last day to avoid any penalty.