Table of Contents

Using this tutorial you will successfully complete the task of How to Apply Visa Card Students -Apply Student Visa Credit Card Let’s go. A current credit card holder has the option of getting an additional card known as an add-on card. Typically, people choose add-on cards for their partners, parents, or kids. For all intents and purposes, the supplemental card functions similarly to a credit card. Except when the parent cardholder selects a sub-limit, the add-on card shares the credit limit with the primary card. Because you can take advantage of all the perks, incentives, and savings offered by the parent card, an add-on card works fantastically as a student credit card.

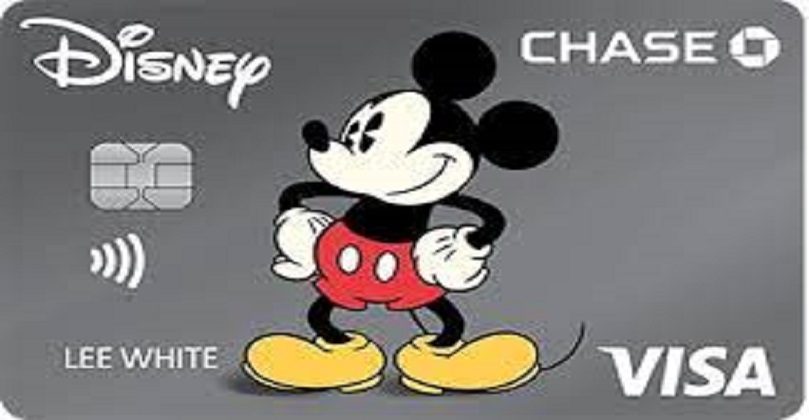

How to Apply for a Student Visa Credit Card: A Comprehensive Guide

Are you a student looking for a credit card to help you build your credit history? Applying for a student visa credit card is a great way to start. In this article, we will provide you with a step-by-step guide on how to apply for a student visa credit card.

Determine Your Eligibility

To be eligible for a student visa credit card, you must be a student who is at least 18 years old and has a valid Social Security number. You also need to have a source of income or a cosigner who has a good credit history.

Research Your Options

Before applying for a student visa credit card, it’s important to research your options. Look for cards that offer rewards, low interest rates, and no annual fees. You can compare different cards online or through your bank.

Gather Your Information

To apply for a student visa credit card, you will need to gather your personal information, including your name, address, phone number, and email address. You will also need to provide your Social Security number and your annual income.

Submit Your Application

Once you have gathered all the necessary information, you can submit your application. You can apply online or through your bank. The application process typically takes a few minutes to complete.

Wait for Approval

After you have submitted your application, you will need to wait for approval. The approval process can take a few days to a few weeks, depending on the credit card issuer.

Activate Your Card

Once you have been approved for a student visa credit card, you will need to activate your card. You can typically do this online or by calling the credit card issuer.

Understanding Poland’s Student Visa

- Poland Student Visa OverviewTo study in Poland, international students typically require a National D-type student visa. This visa allows students to stay in the country for the duration of their studies and also provides the opportunity to work part-time during their studies.

- Application ProcessThe student visa application process involves several steps. First, prospective students must be accepted into a Polish educational institution and obtain a letter of acceptance. Then, they need to gather the necessary documents, including proof of financial means, medical insurance, and a valid passport. Finally, they must submit their visa application at the nearest Polish consulate or embassy.

- Factors Influencing the Success RateVarious factors can influence the success rate of obtaining a Poland student visa. Some of the key factors include:

- Academic Excellence: Demonstrating strong academic achievements and meeting the admission requirements of the chosen Polish institution significantly increases the chances of visa approval.

- Financial Stability: Providing evidence of sufficient financial resources to cover tuition fees, living expenses, and potential emergencies is crucial. It assures the visa authorities that the student will not become a financial burden on the Polish government.

- Valid Health Insurance: Having comprehensive health insurance coverage is mandatory for obtaining a student visa. Students must ensure they have appropriate medical insurance before submitting their visa application.

- Fluency in English or Polish: Proficiency in the English language, or Polish for non-English programs, is important for academic success in Poland. A good command of the language can positively impact the visa approval process.

- Clear Statement of Purpose: Students should articulate their academic and career goals clearly in their statement of purpose, demonstrating a genuine interest in studying in Poland and contributing positively to society.

Poland Student Visa Success Rate and Statistics

Gathering accurate data on the exact student visa success rate in Poland can be challenging. However, based on anecdotal evidence and experiences shared by international students, Poland has a relatively high student visa success rate compared to other European countries. The country is known for its openness to international students and welcomes individuals from diverse backgrounds.

While it is difficult to provide an exact percentage, the success rate can vary depending on the student’s individual circumstances, compliance with the visa requirements, and the credibility of the chosen educational institution.

FAQs:

What are the benefits of having a student visa credit card?

Having a student visa credit card can help you build your credit history, which is important when applying for loans or other types of credit in the future. Many student visa credit cards also offer rewards, such as cashback or points that can be redeemed for travel or merchandise.

What is the difference between a student visa credit card and a regular credit card?

A student visa credit card is designed specifically for students who are just starting to build their credit history. These cards typically have lower credit limits and higher interest rates than regular credit cards. However, they also often offer rewards and perks that are tailored to students’ needs.

What should I look for when choosing a student visa credit card?

When choosing a student visa credit card, look for cards that offer rewards, low interest rates, and no annual fees. You should also consider the credit card issuer’s reputation and customer service.

Final Words:

Applying for a student visa credit card is a great way to start building your credit history. By following the steps outlined in this article, you can apply for a student visa credit card with confidence. Remember to do your research, gather your information, and choose a card that offers the benefits you need as a student. With a little effort, you can successfully apply for and use your student visa credit card to build your credit and achieve your financial goals.